Are Massages Covered By Insurance

With many people turning to massage therapy as a medical treatment, it seems that health insurance should cover massages. However, not all policies do.

For example, Medicare does not cover massage therapy, so you will likely be responsible for 100% of the costs if you seek this treatment. Even if your health insurance provides coverage, there may still be limitations.

The definition of massage therapy may vary, depending on the insurer. That definition of massage, and the reason youre getting one, will likely determine whether insurance will cover it.

If massage treatment isnt covered in your policy, be sure to ask about alternative options. Its also a good idea to discuss them with your doctor.

Smarter Than A Credit Card Safer Than Cash

- Cash is easily lost or stolen

- A fleet card adds transparency, security and control

Keep more of your money in your business, where it belongs.Apply for a fleet card today!

Lance, NexGen

Vincent, NexGenElena, WEXPatsHilary, Women@WEXSophia, WEXVets

Your WEX benefits debit card makes it easy to spend your funds on eligible expenses.

Where does it work? Our card works at a variety of merchants. Specifically, you can use it anywhere with an Inventory Information Approval System or at merchants that meet the IRS 90 percent rule .

How does it work? If used at an IIAS merchant, simply swipe your card and it will automatically approve anything thats an eligible expense. If used elsewhere, you may need to upload supporting documentation .

What if additional documentation is required? You can view the status of your claims and upload documentation easily with our benefits mobile app or through your online account.

Find Out If You Qualify For Massage Coverage

Some, but not all, insurance providers, offer HSAs with their HDHPs.

The first step is to contact your insurance company. Even if your doctor rules massage as medically necessary, some insurance policies still wont cover massages. Dont assume youre covered just because your doctor prescribed the massage. Confirm with your insurance provider before moving forward.

Another important thing to note: self-employed individuals can qualify for HSAs, but are not eligible to open FSAs. This is due to HSAs being owned by the employee, whereas FSAs are owned by your employer. You legally cant make contributions to yourself.

Don’t Miss: Massage Envy Citrus Park Fl

Wait Can I The Short Answer Is Yes

Its like brewing a cup of Double Happiness blooming tea from our sister store, the Bond and Bangs apothecary

WHY?

Not only will the prescription needed from your doctor to use your HSA cash for massage actually cover the massage expense, but medical prescriptions for massage also allow you to forgo paying SALES TAX on each service! DOUBLE HAPPINESS, you see?

So what about stress reduction? massage therapy recommended by a physician to treat a specific injury or trauma, then it would qualify with a letter of medical necessity. . If you have prescriptions for conditions that are covered like stress, diabetes, anxiety, arthritis, fibromyalgia, migraines, back pain, neck pain, hip painLETS SWIPE YOUR CARD!

You May Like: Split King Adjustable Base With Pillow Tilt & Massage

Credit Card Reward Points

HSA owners can pay for their qualified medical expenses with a credit card that has cash back points, airline miles or other perks and then reimburse themselves from their HSA for those expenses. This can be a great way to “work the system” and get credit card perks as long as the medical expense was incurred while the HSA was open.

Remember that if a credit card is used to cover medical expenses there may be interest charged if the balance is not repaid on time. If used properly though, this can be a great way to get benefits from a credit card for expenses that have to be paid anyway.

You May Like: Massage Therapy Schools In Canada

How Do I Use My Fsa/hsa

The first step in using your FSA or HSA money for massage therapy is to pay a visit to your primary care doctor. Let the doctor know you have an FSA or HSA and are seeking massage therapy as the solution to a medically eligible condition. The doctor will write a prescription for your massage if he/she deems it to be medically necessary.

Your prescription will need to include the following:

- A reason for your massage therapy treatment, such as a medical condition or to relieve chronic back pains.

- The number of sessions youll need or the frequency of your visits

- The length of the treatments needed.

Once you have received the prescription, file it away in case you are asked to show proof of the expense. You can use your FSA/HSA card to pay for massage services online or in-person. Just remember, tips are not considered a medical expense.

Donotpay Can Track All Of Your Subscriptions

If you keep seeing charges on your credit card that you cant explain, chances are that subscription services are to blame. Monthly subscriptions are attractive but, if you dont pay attention, you could spend a fortune on them. An average person spends over $200 every month on subscription services, without even realizing it.

DoNotPay can help you get rid of unused subscriptions and save a lot of money. All you have to do is connect your bank or email account to the app and youll be able to monitor all the services that youre paying for. We will help you find the unused subscriptions and cancel them in only a few minutes.

You May Like: Healing Hands Massage West Chester Pa

Use Your Hsa/fsa For Massage

Ok, Ill have to apologize to those who didnt know, but Ive been accepting Health Savings Accounts and Flex Spending Accounts for a while now. I know these accounts have become more popular due to higher deductible plans and many companies contribute to these accounts. For the moment, these accounts are the next best thing to accepting insurance in my practice.

Question : How Much Money Should I Put In My Fsa Or Hsa

Healthcare FSA: First, calculate how much youre likely to spend on medical expenses for this year. Then contribute that amount to your healthcare flexible spending account. Just make sure youre not contributing more than the legal limit. Also, you dont want to over contribute, because if you dont use your FSA funds by the end of the year, you lose it. More on that later.

Dependent care FSA: Because childcare costs are really high, families typically contribute the max for a dependent care FSA. Again, you must use the full amount by the end of the year.

HSA: I personally use my HSA account as a retirement investment vehicle. Remember, you can invest your HSA funds in stocks or bonds if you choose the right provider. If youre eligible for an HSA, and you have extra cash, it can be advantageous for you to just max out your HSA and invest the money and not even use it for medical expenses until you retire, so you can maximize its tax-free growth feature.

Also Check: Does Medicare Cover Massage Chairs

Getting A Prescription For Massage Therapy

If you want to use massage therapy to treat or prevent a physical or mental ailment, you will first need to make an appointment with your primary care doctor or chiropractor. Explain to him or her that you have an FSA and would like to use some of the funds for massage therapy to treat or prevent the condition that you are experiencing.

Under IRS regulations, your physician will need to include the following information on your prescription in order for it to qualify for FSA funds:

- Therapeutic Necessity Why do you need massage therapy services? This may be to relieve stress and anxiety, to relieve back or neck pain, or even to prevent certain conditions that you may be prone to due to your occupation or activity level.

- Number of Sessions per month How frequent do you need treatment? Many clients see benefits from 1 to 2 sessions per month, but your doctor or massage therapist can help recommend how many sessions are appropriate. You can also check in with your doctor regularly to adjust session amounts.

- Duration of Treatment How long should you continue receiving treatment? Again, this will vary. Your doctor or chiropractor will be able to recommend the appropriate duration, and again, you can check in with your physician periodically to adjust session duration.

After you have the prescription, you should keep this with you for tax purposes. If you ever need to verify the expense, you will have the prescription right there in your files.

Why Did Uhc Drop Silver Sneakers

According to Sam Warner, who leads UHCs Medicare Advantage product team, the companys move away from SilverSneakers® is to reach a broader portion of our membership with a wider variety of fitness resources. Warner noted that over 90 percent of policyholders who are eligible for SilverSneakers® never step foot

You May Like: Biotone Dual Purpose Massage Creme 5 Gallon

Question : Where Can You Open A Health Savings Account

The beauty of an HSA is you can open one through any HSA provider of your choice. You dont even have to choose the HSA thats provided by your employer. Why would you not want to choose the HSA provided by your employer? Because there are much better HSA providers out there. Giving advice on the best HSA provider where you can have really low-cost investment options is one of the things we provide for our financial planning clients.

Hsa Vs Fsa: Which One Should You Get

In this blog, we are going to discuss the ins and outs of Health Savings Accounts vs Flexible Spending Accounts . Many people have access to both, and it can help you lower your taxes. If youre wondering which is better for you, read on for the 13 most commonly asked questions about HSA vs FSA.

Also Check: Jsg School Of Massage Therapy

Which Massage Guns Can I Buy With My Fsa Or Hsa Card

There are only a few brands of massage gun that are officially eligible for use with an FSA or HSA card. Zarifa USA are a company whose products are HSA/FSA eligible. Their products are FDA approved Class I and II devices. Because they are DME certified and classed as medical equipment, they can be used to treat a medical condition.

Their massage gun, the Z Smart Massage Guncan be purchased using a HSA, FSA or HRA card. Just add the massage gun to the basket and checkout as normal. Instead of entering your credit card details, enter the details of your health card.

Get 10% offour exclusive coupon code HMG

The Z Smart Mini Massage Gun is also FSA Eligible and available at Zarifa USA.

Dont purchase without following your FSA providers guidelines!

You need to have a valid medical reason to purchase a massage gun using HSA or FSA. You cant just buy a massage gun because you want to enjoy a relaxing massage. They are only eligible for medical spending. A massage gun can be used to treat muscle issues, circulation problems or pain and stiffness. You should see your doctor to get a prescription before you buy as some FSA providers require a doctors prescription.

Donât Miss: Massage For Stress And Anxiety

Do Massage Envy Gift Cards Expire

Insider sources suggest that Massage Envy Spa gift cards do not have fixed expiration dates. Nevertheless, we recommend that you redeem them at your earliest possible opportunity to avoid any unforeseeable complications with booking your appointment.

Get free estimates on Thervo from trusted massage therapy services:

You May Like: Massage Place At The Greene

Question : Can I Change My Flexible Spending Account Amount

Lets say in the middle of the year, you have the urge to get massages every month, & you can get a prescription from your doctor. But you didnt figure those costs in when you initially computed your FSA. You cant just increase it in the middle of the year.

You can change your FSA amount outside of Open Enrollment only if you have a mid-year qualifying event, which includes: change in marital status , change in a number of tax dependents , or employment changes .

You Can Now Use Your Hsa Or Fsa Card To Pay For Massage Therapy Services

Massage Therapy can be perscribed under the required medical expense , the IRS regulations state that medical care expenses MUST be primarily to alleviate or prevent a physical or mental ailment. In IRS Publication 502 , Therapy is included as defined for therapy received as medical treatment.

Examples of illnesses that could qualify include carpal tunnel syndrome, stress, back pain, arthritis, diabetes, hypertension, fibromyalgia, chronic fatigue, anxiety, depression and pain management.Schedule an appointment with your doctor. If you have been suffering from any of the above conditions, including stress, let him or her know that you are participating in a HSA and or FSA and that youd like to use some of your funds toward massage for treatment or prevention of your condition.

In order for you prescription to qualify for IRS regulations, yourphysician will need to provide the following:

1. Why do you need massage therapy? As a treatment plan and preventative measure.

2. How frequent do you need treatment?

3. How long should you receive treatment?

After youve obtained your prescription, keep it with your tax documents should you ever be asked to verify the expense.

For my clients, it is not necessary that I receive a copy of your subscription, but it is helpful so that I may provide you with a more detailed receipt for your records.

Dont Miss: I Got Your Back Massage Therapy

Don’t Miss: Synca Kagra 4d Massage Chair Reviews

Question 1: What Is The Difference Between Hsa And Fsa

The biggest difference between FSA and HSA is that HSA contributions are yours for the rest of your life, while FSAs are less flexible and you forfeit any unused balance unless your employer allows a rollover. HSAs have higher contribution limits and you can change your contributions whenever. Many HSA plans allow contributions to be invested in stocks or bonds. . FSAs have lower contribution limits and the contributions can only be adjusted during open enrollment or with a change in employment or family status.

Question : Who Is Eligible For A Health Savings Account

To be eligible for a health savings account, youll need to have a high deductible health insurance plan PLUS your health insurance plan needs to be HSA-eligible.

A common mistake people make is assuming that their high deductible health plan makes them automatically eligible for an HSA. A high deductible plan doesnt necessarily mean its HSA eligible. Some high deductible plans have cost-sharing agreements, meaning you get discounts on certain medical costs, which make it ineligible for an HSA.

For example, I have a high deductible plan with CareFirst, but its not HSA eligible. I was very sad that I couldnt contribute further to my HSA. One trick to quickly find out if youre eligible for an HSA: If your health insurance card has the word HSA in the name of the plan, most likely youre eligible for a health savings account. It doesnt always have this in the name if its eligible, but if it does, you know its likely eligible.

Read Also: Can Massaging Your Scalp Make Your Hair Grow

Why Would You Want An Hsa Or Fsa

HSAs and FSAs have numerous advantages, the most important being the ability to save money. Furthermore, even though nobody wants to believe they could experience a medical catastrophe, emergencies do happen. Therefore, keeping some cash available in case of unexpected health expenses is vital for your sense of financial security.

Things To Keep In Mind

When requesting a massage therapy prescription from a doctor, make sure youre coming at it with the right intentions. The purpose of your health insurance is to cover medical expenses, and massage therapy can be a great way to benefit your health. Be honest when speaking with your doctor regarding your symptoms and why you think massage would be a beneficial therapy.

And for the sake of your financial health, make sure you only use your HSA or FSA for massage therapy expenses if you have a prescription from your doctor. Its also important that you keep track of your records for tax time. Zeel makes this easy by itemizing every receipt youll have a copy sent to your inbox after every massage. Weve got your back!

Donât Miss: Massage Envy West End Nashville

Read Also: Deep Tissue Massage For Hip Pain

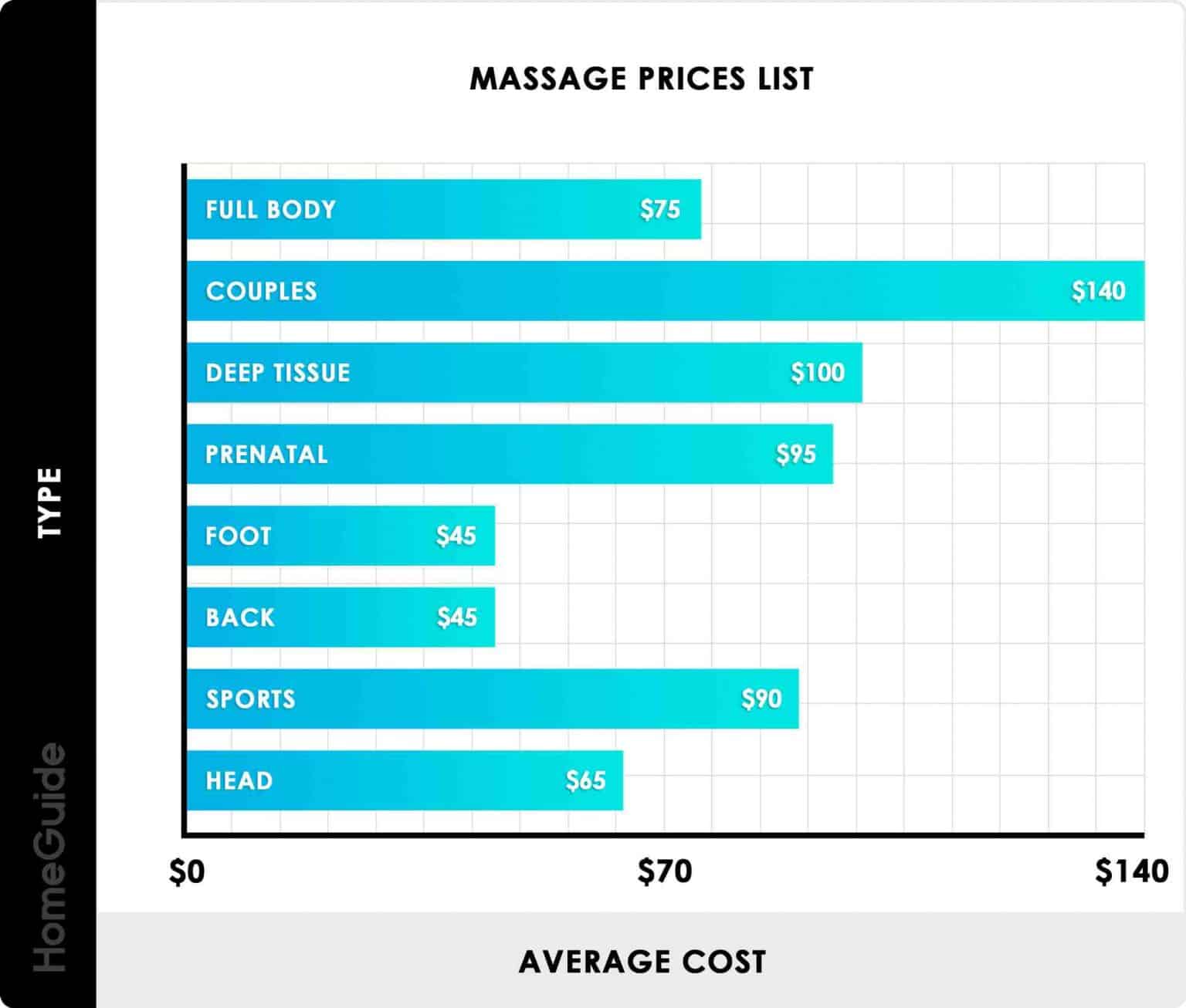

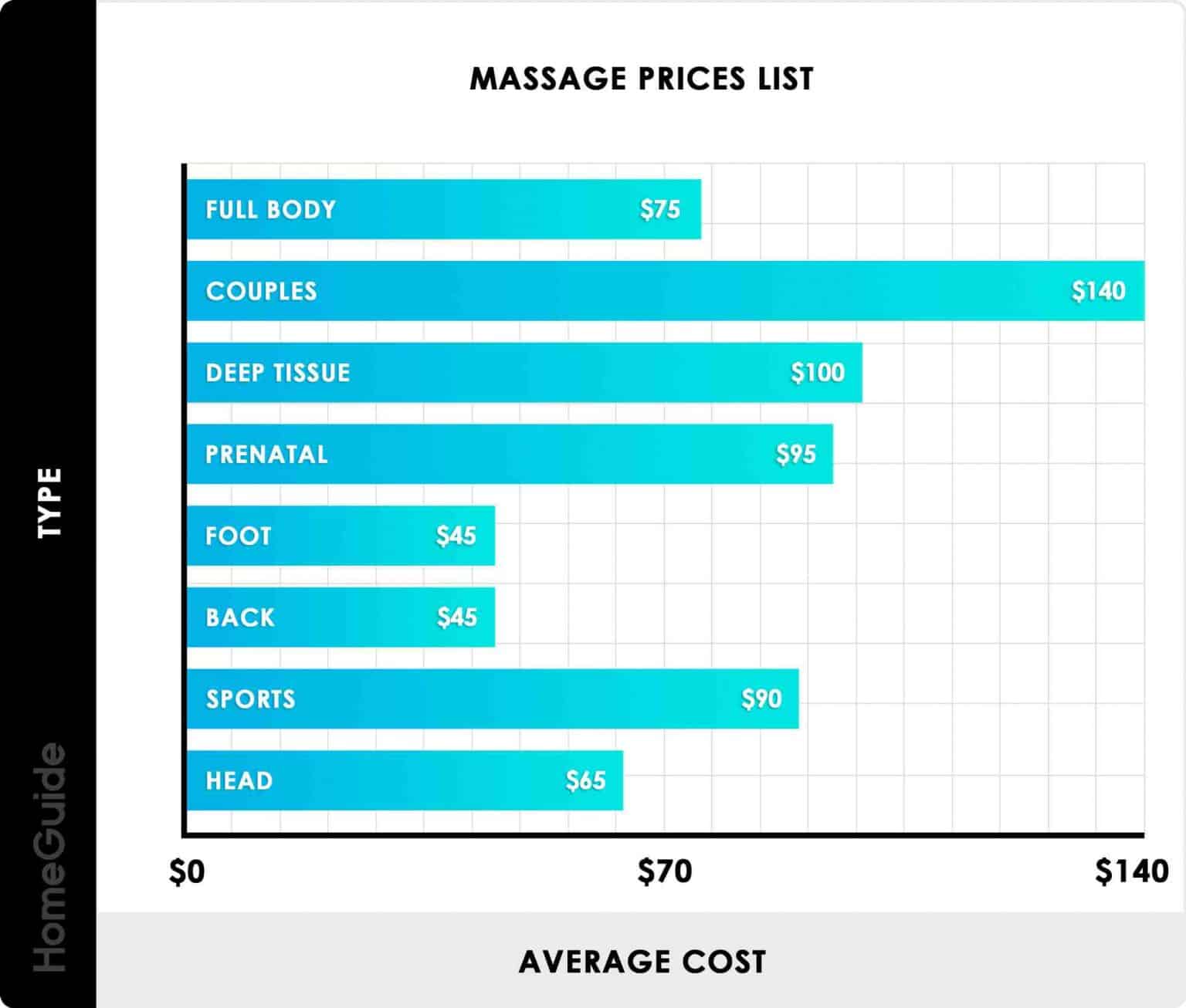

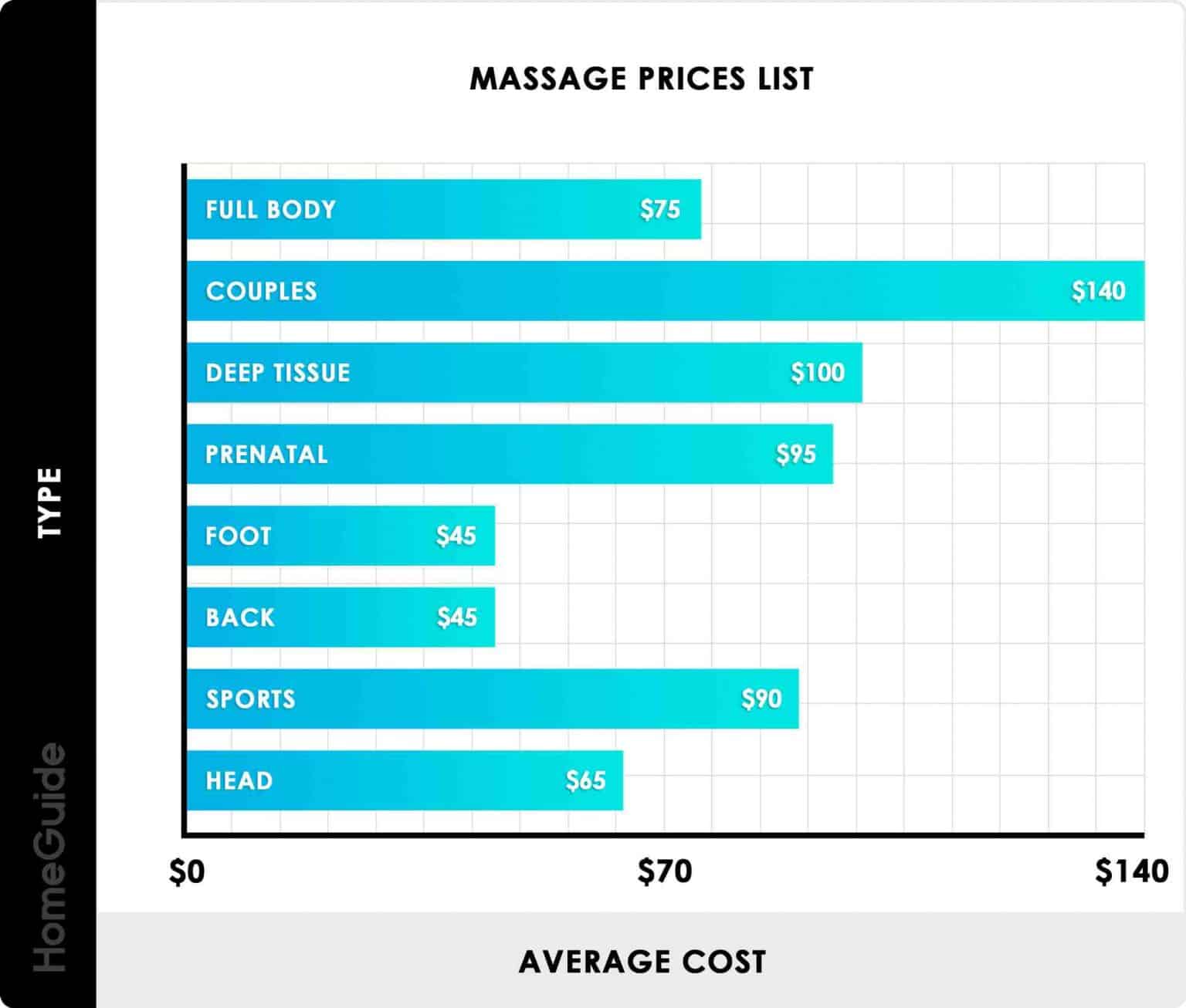

Hot Stone Massage Cost

The Massage Envy Hot Stone Envy treatment is a signature service that costs $25 extra as an optional add-on for a 90-minute massage. Since you have to book the 90-minute session first, you could expect to pay in the range of $100 to $160 total for a hot stone massage, depending on whether or not you have membership benefits. At some locations, non-members pay up to $240 for a Hot Stone Envy massage.

Massage Therapy Reimbursement: Hsa/fsa

Has your doctor recommended massage therapy as a part of your treatment plan? Have you wondered if massage might improve your condition? You could be eligible to use your Health Savings Account or Flexible Spending Account to pay for massage therapy!

Massage therapy is regarded as less of a luxury item. Instead, it now considered a beneficial activity for overall health and wellness. Some companies even offer massage to employees as a perk of working there. These employers know it lessens stress and anxiety, thus making their employees more productive in the long run.

According to a survey conducted by the American Massage Therapy Association, 88% of consumers regard massage therapy as beneficial to health and wellness. There is a growing trend of acceptance among medical professionals. They largely consider massage therapy as a valid treatment for many ailments. Massage has been shown to be beneficial in treating sports injuries, anxiety, depression, migraines, and much more. Massage therapy is helpful in promoting range of motion, reducing scarring following surgeries, as well as mitigating the impact of cancer treatments on the body.

Recommended Reading: Marketing Plan For Massage Therapy Business