Massage Therapy Liability Insurance

Now, liability insurance isnt a one size fits all. There are different kinds of liability policies. Each one is designed to cover a specific set of risks your business faces.

You knew that, right?

As a massage therapist, youll need two different types of liability insurance:

General liability insurance Professional liability insurance .

How Can I Improve My Massage Business

for Massage 1) Distribute postcards. It doesnt matter whether you provide mobile massage or your clients come to you. 2) Organize an open house. 3) Implement a Loyalty Reward Program. 4) Make package deals available. 5) Make Appointments Via the Internet. 6) Create a blog. 7) Discover your niche. 8) Make the switch to mobile.

Why Massage Therapists And Bodyworkers Need Insurance

No practitioner ever intends to hurt a client, but it happens. From falling off a massage chair, to tripping on rugs, to suffering bruising or broken ribs when a practitioner applies massage too deeply, clients can come away from your sessions injured.

That is why professional massage liability insurance is the safety net every massage therapist and bodyworker needs to protect themselves. The peace of mind that comes with this protection is priceless it allows you to focus on your craft and not the unexpected.

Also Check: Massage Places In Palm Springs

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Why You Need Massage Therapy Liability Insurance

Because youre human.

We all make mistakes. Oversights happen, even if only on rare occasions. It only takes one slip up in an otherwise perfect practice to get you in trouble.

It may be unlikely that a client brings a lawsuit against you, but it could happen. Just like any other type of insurance, massage therapy liability insurance protects you and your assets. And if theres one thing in life that remains consistent, its that theres always something unexpected right around the corner.

In the event that a lawsuit is brought against you, your massage therapy liability insurance will pay for damages. Without it, if youre held liable, you could be draining your bank accounts to pay for your mistakes. For a relatively low investment, you can prevent that from happening.

Hopefully, you never have to use it, and all it offers you is peace of mind. Either way, its more than worth it.

Don’t Miss: Hand And Stone Massage Gaston

Is It Hard To Find Clients As A Massage Therapist

When youre just starting out, finding massage customers may be difficultand if youre depending on word-of-mouth marketing at a time when few people know your name, you may find yourself having a lot of open slots in your schedule. Here are five client-acquisition tactics that might help you get started in the industry.

Stay On Top Of Your Financial Admin With Countingup

When you apply for insurance or make a claim, it can be beneficial if your finances are organised, and you can provide accurate information to your insurer quickly and easily.

Thousands of business owners are using the Countingup app to save time on their financial admin and focus on growing their business.

Countingup is the business current account and accounting software in one app. It automates time-consuming bookkeeping admin for self-employed people across the UK.

With automatic expense categorisation, receipt capture tools and cash flow insights, you can confidently keep on top of your business finances and save yourself hours of accounting admin, so you can focus on doing what you do best. Find out more here.

You May Like: Self Prostate Massage Therapy Benefits

Do Massage Centers Need Insurance

As a massage wellness center, you might be wondering if you need massage therapist insurance coverage.

Perhaps youre an employee of a massage center and there is already an overarching business insurance policy in place for employees. Or perhaps you own the massage center, and as a small business owner, youre wondering what type of insurance you need to protect your business, your employees, and you.

In both casesas the individual employee and as the employerthe short answer is: yes, you will need insurance. Massage therapists, like all health professionals, carry substantial inherent liability due to the nature of their practice. Below, youll read about what types of insurance you need and why.

What If I Dont Have Insurance

Any legal claim from a client is tough to imagine, whether it be for an accident that took place on a massage practices premises or because of some kind of harm done during the massage or due to a product used in the session room. However, even though these claims appear to be fairly few, they can and do occur. Taking a gamble that no client will ever sue, the practitioner who chooses to forgo liability insurance faces great risk.

Massage therapists are leaving themselves open to significant financial risk if they dont insure, Naismith said. If they were to get sued, and there was a judgment against them, it could financially ruin their practice and also invade their personal finances as well.

Besides financial losses that can occur when an uninsured massage therapist gets sued, another risk of skipping liability insurance is what Naismith calls the aggravation factor. Without liability insurance, the individual massage therapist is responsible for managing the complicated legal process associated with a lawsuit.

If Im sued, and I have insurance, Im going to report it to the insurance company, and theyre going to take over investigating that claim, so it relieves me of the burden of having to take responsibility for handling that, Naismith said. Without insurance, you dont have the insurance company as a partner to help you through the legal process and to take the financial responsibility of paying the claim if its a legitimate claim.

Also Check: Hilton Head Island Massage Therapy

What Does Massage Therapy Liability Insurance Cover

At the very least, your comprehensive Massage Therapy Liability insurance policy should include:

- General Massage Liability Insurance This is the go-to Massage Liability Insurance that every massage therapist should have regardless of training or experience. A General Massage Liability Insurance policy protects massage therapists against third party claims, such as a slip-and-fall injury.

- Massage Therapist Malpractice InsuranceMassage Therapist Malpractice Insurance is a type of Professional Liability Insurance for massage therapists. Massage Therapy Malpractice Insurance protects massage therapists against claims related to professional activities, such as advice- or treatment-related injuries.

Talk to your broker about customizing your Massage Liability Insurance policy to include additional types of coverage.

My client signed a liability waiver, do I still need Massage Therapy Malpractice Insurance?

Yes. Massage Malpractice Insurance can protect you where a waiver wont. Waivers are not always enforceable forms of protection in a court of law. For that reason, it is best to cover your bases and include a Massage Malpractice Insurance policy in your risk management strategy.

Cohesive Liability Coverage Empowers Employees

But massage therapy liability insurance coverage isnt all specifically for the benefit of you, your practice, and your patients. Its also a crucial piece of the puzzle for employees, like a massage therapist who works for you. Massage therapists can invest in their own professional liability insurance, but that doesnt mean that you cant offer them coverage under your policy.

When you offer a massage therapist who works in your office the peace of mind that comes with liability protection, youre offering them the chance to do their jobs better. In other words, if theyre not constantly concerned about what might happen should a claim roll in , theyll be far more empowered to do their jobs well.

While massage therapy liability insurance in your chiropractic office might cost more than a previous plan, its a far more powerful investment. Youre protecting the professional massage therapist and encouraging them to perform to their best ability, worry-free about the unlikely possibility of a claim.

You May Like: How To Start A Vending Massage Chair Business

Massage Therapy: A Thriving Career

The population of massage therapists in the US alone has increased over the years making it one of the most sought after career today. According the American Massage Therapy Association, massage therapy students and massage therapists is over 300,000 in the US and is expected to continue to increase.

This is by far one of the fastest growing employment rate in any field of profession.

The average weekly working hours for massage therapist is about 15 hours excluding other business-related tasks.

Massage practitioners have a wider range of choices when it comes to where they will practice because of valuable service.

Only 27% of massage therapists work under someone elses employment. The other 73% are solo practitioners who are either working in their private spaces, homes, spas, salon, medical or corporate offices.

Do Massage Therapists Have Insurance Coverage Through Their Employer

Massage therapists who work for spas or other businesses as employees might receive insurance coverage through their place of employment. Not all employers provide coverage for employees, though, and sometimes the coverage afforded isnt as robust as therapists would like it to be. Any provided coverage also usually doesnt extend to side gigs that arent done through the employer.

Because of these caveats, massage therapists who work as traditional employees normally should speak with a knowledgeable insurance agent before they simply trust that their employer provides adequate insurance coverage. A specialized agent will be able to review an employers policy to see what protections it gives employees, and then the agent can help a therapist decide whether they need to purchase additional protection.

This matter normally doesnt apply to massage therapists who work as independent contractors and therefore, are typically viewed as business owners rather than traditional employees.

Mike Bancroft is simply an amazing agent. When my business got burglarized, I was so upset and didn’t know what to do. I contacted Mike and he was very prompt in calling me back and he put my mind at ease. He made me feel so much better and handled all of the paperwork immediately. His customer service is top notch and I highly recommend him to be your insurance agent!

Recommended Reading: Synca Circ Massage Chair Review

What Factors Should A Massage Therapist Consider When Researching Liability Insurance Companies

- Covered modalities. Make sure it includes the types of massage and bodywork services that you provide.

- Amount of coverage.

- Types of insurance. Many companies also include general liability and product liability coverage. Make sure the policy will include the coverage that you need.

- Customer support. Choose a company that provides you the level of support that you need.

- Additional useful benefits like free continuing education courses, magazine subscription, and discounts from other vendors.

- Stability of the company.

- Cost. If everything else is equal, then cost is the last consideration. A $30 price difference is insignificant if its between purchasing a good policy from a reputable company or purchasing from a company that may not provide protection when you need it. Think of it like this, you wouldnt want to buy the cheapest seatbelt on the market.

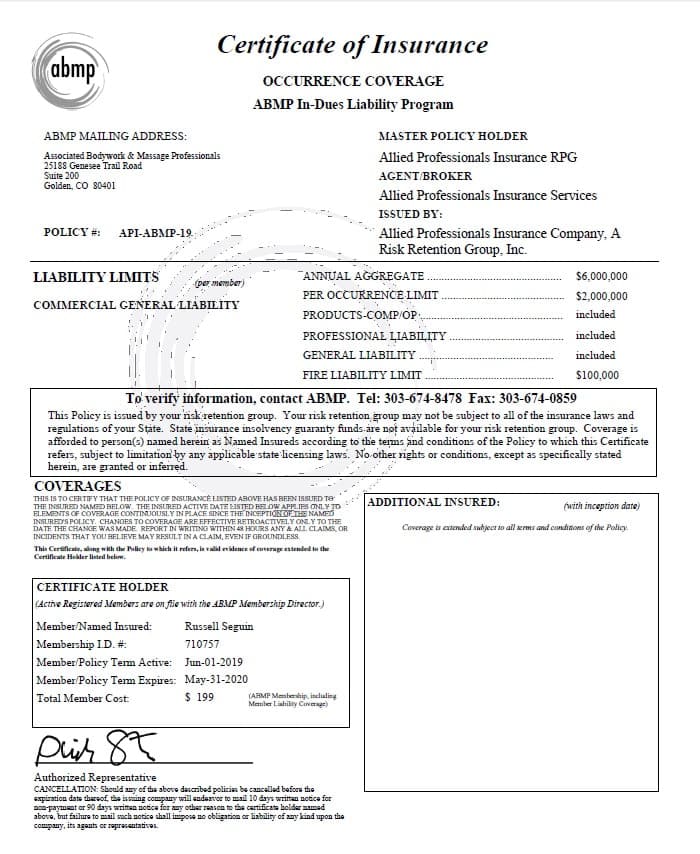

Hot Stone Coverage And More

Coverage for hot stone massage is included in AMTA’s insurance – with no extra costs or classes you have to take!

Unlike some companies, we won’t charge you to add an Additional Insured entity to your coverage, such as your landlord or employer. And downloading or emailing your Certificate of Insurance is also free, and both are simple to do with the click of a button directly from your AMTA member profile. We want to make it easy for you to be covered.

Recommended Reading: Commercial Massage Chair With Bill Acceptor

General Liability Insurance For Massage Therapy

General liability insurance really is just that. General coverage for a wide range of different events. General liability is something youve probably heard being called slip and fall insurance. Thats because this type of injury is unfortunately common and can actually cause serious injuries. The National Safety Council notes that hundreds of thousands of ER visits occur each year from slips and falls.

Now, this type of injury is definitely the one that gets all the press but there are many other forms of risk that fall under general liability. You can think of this coverage as an umbrella that protects you from third-party claims for injuries or property damage that occur in or around your massage suite.

General Liability Claim Example: A client is walking into their massage session when they slip and fall on your freshly waxed floors. Their injuries are severe and they need an ambulance. When all is said and done, you receive notice they intend to file suit for all the bills they have.

Professional Liability Claims Scenarios

Bodily injury caused by your treatment You perform a deep tissue massage on a client complaining of shoulder pain before treatment. During a shoulder stretch on the massage chair, he winces and asks you to stop. You do so, immediately.

The next day, your client accuses you of causing a torn ligament in his shoulder. He needs surgery, he says, and is suing you to recoup the cost.

In this situation, your professional liability policy could take care of the costs of such a claim. If the case goes to court, itll hire you an attorney and pay your legal fees. And if it turns out compensation is due, it could cover that too.

Sexual misconduct and abuse A new client comes to you for osteoarthritis treatment. You get consent, apply proper draping techniques and observe professional boundaries. But after a Swedish massage, she files a complaint saying you touched her inappropriately. Its caused her emotional distress and shes been forced to take time off work.

In this instance, your policy could pay for an attorney to defend you, as well as legal fees and damages if theyre due.

Loss of personal information You misplace a file containing a clients medical history and financial details. The file falls into the wrong hands and your clients identity is stolen along with a large sum of money.

Professional liability insurance can protect you from the cost if you get sued as a result.

Don’t Miss: Nrg Grasshopper Massage Chair Review

General Massage Liability Insurance: Breaking Things Down

One of the most important things to understand about massage insurance coverage is that, depending on where you live, you may actually need to carry this type of policy to even get your massage therapy license in the first place. As of 2019, these states include:

- South Dakota, which also requires a policy limit of at least $250,000.

- Wisconsin, which requires a policy limit of at least $1 million.

- Indiana, which does not have a specific policy limit.

- Alabama, which also requires a $1 million policy limit.

- Massachusetts, again with a $1 million policy limit.

Running a business in this type of field brings with it a certain degree of risk. Someone has come to you with help for an existing health condition, and you may end up making that condition worse. You could cause injury or someone could simply trip and fall when trying to leave your physical place of business you just dont know.

This is why, even if youre operating in one of the many states that do NOT require liability massage therapy insurance to get your massage therapy license, taking the initiative and getting such a policy will always be a good idea.

While these types of policies will always have subtle differences depending on your provider, generally speaking, they all work the same way:

Public Relations Crisis Management Service

In today’s 24 hour news culture, public relations disasters can occur at any time. Having to deal with the press whilst managing a difficult situation can be hugely stressful as well as being a potential minefield. When there is a risk to your business as a result of negative press attention, our specialist public relations crisis management firm, The Counsel House, will work with you to help manage allegations of fraud, injury caused to employees or the public, and official investigations into your company’s affairs. Included as standard with public liability and professional indemnity insurance, directors and officers insurance, cyber and data risks insurance and legal representation and employment disputes insurance.

Recommended Reading: Bliss Massage Spa Arlington Va 22207

What Is A Superbill For Massage Therapy

A superbill is a thorough invoice that details the services provided to a customer. When a therapist is not on a clients insurance companys panel, they may need to create a superbill. The therapist or client sends the superbill directly to the insurance, including all of the information necessary for the claim to be paid.

What Other Types Of Insurance Coverage Should Massage Therapists Consider Getting In Addition To Liability Insurance

Workers compensation insurance which pays the medical costs of personal injuries sustained during work.Disability insurance to pay a monthly benefit if you become disabled and unable to work Commercial auto insurance to protect your business if you offer mobile massage or otherwise use your car for work. It also protects a company vehicle if involved in a collision, or if it is stolen or vandalized.Business interruption insurance provides protection for the loss of revenue and coverage of continued fixed expenses that results from a temporary business closure. This disruption of business could be caused by damage from a flood, hurricane, earthquake or fire. Or other causes such as a pandemic and mandatory business shutdown.

Read Also: Hand And Stone Massage Careers