Questions To Ask About Massage Therapy Coverage

If you learn that your insurer covers massage therapy, ask these questions so you will understand how your policy will cover it:

- What are the conditions to qualify for reimbursement?

- Is there is a deductible or any out-of-pocket cost to you?

- Is there is a maximum amount payable per policy term/year?

- Is there a maximum reimbursement per visit? For example, if the maximum per visit is $90, and you use a massage therapist who will charge $150, you will not be able to claim the full amount.

- Is there a time limit per body region?

- Are there specific massage therapists you must go to?

- Do all types of massage qualify for coverage?

Can I Use My Hsa Or Fsa For A Massage

Did you know? Massage Therapy is eligible for reimbursement through most FSA’s and HSA’s. Some do require a Letter of Medical Necessity from your doctor, but this means you can potentially be reimbursed from your insurance for your massage from us! You just need a note from your primary care physician.

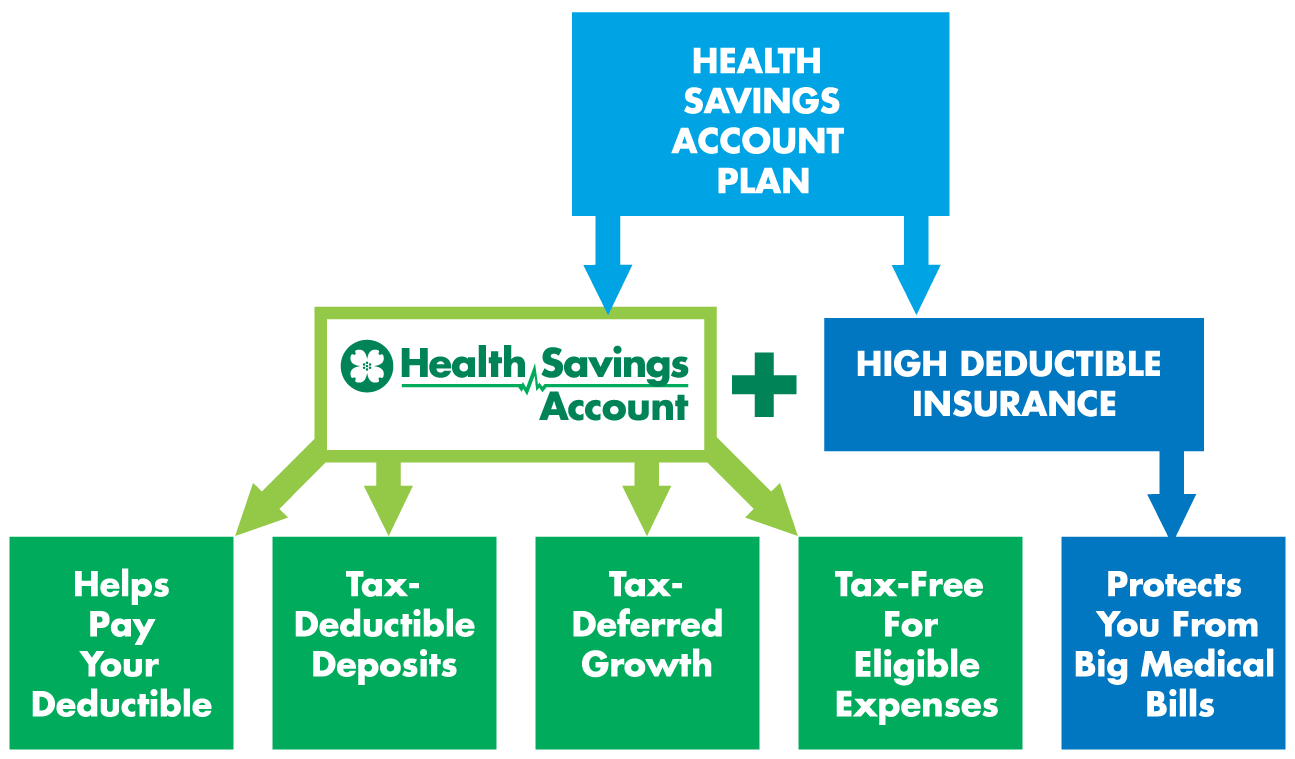

Both FSA’s and HSA’s are tax-advantaged accounts that let people save money to pay for qualified medical expenses, but they have a few important differences:

HSA :

An HSA is a tax-advantaged medical savings account for taxpayers in the US who are enrolled in a high-deductible health plan . The money in your HSA can be used to help pay health insurance deductibles and medical expenses, including Dental and Vision care. The 2019 annual limit for contributing funds for individuals with single medical coverage is $3,500. The annual contribution limit is $7,000 for those covered under family medical plans. If money is withdrawn for qualified medical expenses, it is never taxed. However, If money is withdrawn for other purposes prior to age 65, you’ll owe 20% taxes on the amount withdrawn. After age 65, money can be withdrawn without penalty.

FSA :

How to use HSA or FSA for Massage Therapy:

The physician must provide three pieces of information on your prescription:

1. Why the massage is medically necessary

2. The number of sessions you’ll need or the frequency of your visits

3. The length of the treatments needed.

The form should include:

Can You Pay For Massage Therapy With An Hsa

Are you wondering if you can pay for massage therapy with a health savings account , flexible spending account , or health reimbursement arrangement ? You may also be wondering if this item is eligible or ineligible for reimbursement with your HSA, FSA, or HRA.

You may be able to use your HSA, FSA, or HRA to pay for massage therapy, but only if you have a letter of medical necessity or if your plan specifically allows it.

Don’t Miss: Human Touch Immersion Massage Chair

Credit Card Reward Points

HSA owners can pay for their qualified medical expenses with a credit card that has cash back points, airline miles or other perks and then reimburse themselves from their HSA for those expenses. This can be a great way to work the system and get credit card perks as long as the medical expense was incurred while the HSA was open.

Remember that if a credit card is used to cover medical expenses there may be interest charged if the balance is not repaid on time. If used properly though, this can be a great way to get benefits from a credit card for expenses that have to be paid anyway.

Can You Use Fsa For Massage

Massage therapy can definitely qualify as a medical expense. Massage therapy must however be prescribed by your doctor for it to be eligible. Massage can be used to treat a range of different medical issues including back pain, arthritis, fibromyalgia and more. It can also be used to treat mental health conditions such as depression, anxiety, and stress. If you would like to use massage therapy as treatment you will need to explain to your doctor that you would like to use your FSA funds to pay for massage. Your doctor may then give you a prescription or Letter of Medical Necessity detailing therapeutic necessity, number of sessions and duration of treatment, which can be used to verify the expense.

You May Like: Best Massage Chair For Sale

Therapy Not Covered By Insurance

If your health insurance does not cover massages, but you have a health savings account , you may be able to use it to cover massage costs, if your massage qualifies as medically necessary. Learn more about HSAs and flexible spending accounts here. Contact local massage schools to see whether they offer massages at a discount. Ask for discounts or membership options where you get your massage services.

Using Your Hsa To Pay For Massage Therapy

by Katrina JenkinsMar 8, 2021

In todays world, massage therapy is finally being recognized as a medical service as opposed to a luxury. Yes, there are patients who do seek out massage for the sole purpose of having a spa day, and there is nothing wrong with that. But the majority of patients, at least in my experience as a massage therapist, receive massage for healing purposes. And while most who need a corrective approach are treated for muscle pain or emotional stress, some patients are prescribed massage for injuries or medical conditions.

When its a medical necessity for a specific condition, massage may be eligible for reimbursement. The service can be covered by a health savings account , or a flexible spending account . The two means of assistance differ in ways, so Ill break the topics into two different articles. For now, lets discuss the steps for using HSAs to cover the expense of a medical-massage. Next time, well address FSAs.

Also Check: Best Time To Buy Massage Chair

Can You Use Your Fsa To Buy A Massage Gun

FSA accounts provide more flexibility than regular bank accounts when it comes to purchasing massage guns.

The Internal Revenue Code section 125 provides employees access to cafeteria plans that create Flex accounts within their insurance policies. Cafeteria items were originally referred to by this term, but flex spending has now caught onto it as well.

A flexible spending account can be used to pay for a variety of medical expenses and often for dependent care expenses. The FSA rolls over a portion of its balance every year, just like the HSA.

Patient Protection and Affordable Care Act allows you to carry over up to $500 without losing the funds.

Massage guns can only be purchased with FSA funds after receiving approval from the cafeteria plan provider. Similarly, the HSA does not have clear guidelines for massage guns.

On the other hand, if you look at the approved expense list, youll find that:

- Acupuncture

- Therapy

Are there any specific expenses that are not covered by FSA funds?

There is no mention of massage gear, massage therapy, or massages on that list for starters.

You are likely to be approved for massage treatments if you require them for a medical reason.

You may be required to complete a paper form if you are approved, or simply be able to purchase your massage gun using your FSA debit card.

Are They Really Worth It

Having an HSA or FSA can have tremendous tax benefits that can save you a lot of money at tax time. Plus, it provides a little extra cushion for unexpected emergencies. And since it is deducted from your paycheck, youll have your savings on autopilot.

Even though an HSA and FSA are slightly different, when youre using either to pay for your massage treatments, it will be the same process.

You May Like: How To Massage Clogged Milk Ducts

How To Get Your Massage Covered

Throughout pregnancy and postpartum, there are many pregnancy pains you may experience. Simply talk to your doctor and let them know you have an FSA or HSA and youd like to use some of your funds toward massage for treatment or management of your symptoms.

There are 3 things your physician will need to include in the note:

While you do not need to bring your note/prescription with you to Maternal Massage, you should keep it on hand in case you are ever asked by your insurance to back up the expense. Note that you cant include tips or pay for your entire membership upfront.

Contact us at 385-351-5626 is you have questions or to book your next appointment.

Powerful Muscle Massage Gun For Your Whole Body

The Zarifa Z Smart Massage Gun may be small, but it delivers an intense massage to your entire body in a lightweight and portable package. With our massage gun, you can easily target any area that needs some deep tissue relief, including your neck, lower back, upper back, chest, arms, glutes, calves, hamstrings, IT band, and abductors. Adjust the intensity as necessary as you work the massage gun into the muscles and joints around your body.

You May Like: Massage Envy Maple Grove Mn

What Is A Health Savings Account

An HSA is a type of savings account that allows you to store money for qualifying medical expenses. The money is deposited on a pre-taxed basis, and the untaxed dollars can help lower medical costs. The funds in the HSA can be used to pay deductibles, copayments, coinsurance, as well as other approved expenses.

You can only contribute to your HSA if you first have a high deductible health plan . An HDHP is a health plan with a deductible of at least $1,400 for an individual or $2,800 for a family for the year 2020, that is. The government can change the minimum deductible amount every year, as well as the maximum amount of money you can contribute to the account.

Keep in mind though, you are allowed to change the contribution amount throughout the year, so long as it doesnt exceed the maximum determined by the government. You can also withdraw money from the HSA at any time, but there will be taxes withheld from the amount plus a 10% penalty fee.

Is My Massage An Eligible Charge

The IRS ruling states that medical care expenses must be primarily to alleviate or prevent a physical or mental ailment. So yes. Massage can be a qualified medical expense although most insurances will require a doctors order for it. Examples of illnesses that qualify include carpal tunnel syndrome, stress, back pain, arthritis, sciatica, fibromyalgia, chronic fatigue, anxiety, depression and pain management.

Also Check: Massage Chair Store In Mall

Getting Insurance To Cover Massage

If you want your health insurance to cover massage therapy, you may have to have your massage therapy prescribed or recommended by a doctor. In a recent survey by the American Massage Therapy Association, 67% of respondents said that their physician recommended they get a massage.

Save Now Cash In Later

The concept of save now, cash in later is a great advantage to having an HSA. HSA owners can pay for qualified medical expenses out of pocket and then reimburse themselves at a later date. As long as they keep the receipts and can prove the cost was a qualified medical expense, they can reimburse themselves from their HSA even years after paying the initial medical bill. Learn more at: .

You May Like: Self Massage For Lower Back Pain

How Do I Get An Hsa To Cover My Massage Cost

For an HSA to cover the cost of your massages, you will need a Letter of Medical Necessity prescribing massage from a physician or PA for your specific medical condition. It needs to prescribe how often to receive massage within a specific time frame. Since many physicians arent familiar with prescribing massages, it can be helpful to both get a recommendation from your massage therapist and look up massage therapy research studies specific to your situation.

A LMN needs to be used to specifically treat an actual medical condition or injury. This includes anxiety, depression, hypertension, diabetes, chronic fatigue, and fibromyalgia. – Your Best Defense

-

International Journal of Therapeutic Massage and Bodywork This one gets pretty technical but is great for detailing case studies for those interested.

What You Can Spend Hsas On

Here are some of the items one can purchase with an HSA account. For a comprehensive list of qualified expenses and commentary on potentially qualifying items, visit HealthEquity.com/qme.

Cobra premiums. In the case you lose your job or transition to a new one, HSA funds can be used to pay for Cobra coverage.

Acupuncture. Members can include in medical expenses the amount paid for acupuncture.

Dental. What members pay for the prevention and alleviation of dental disease is a covered expense. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning, the application of sealants and fluoride treatments to prevent tooth decay. Treatments to alleviate dental disease include services of a dentist for procedures such as X-rays, fillings, braces, extractions, dentures and other dental ailments.

Vision. Eye exams are covered, as well as eyeglasses and contact lenses needed for medical reasons. In addition, eye surgery to treat defective vision, such as laser eye surgery or radial keratotomy, is a covered expense.

Alcohol and drug addiction treatment. Inpatient treatment at a therapeutic center for alcohol or drug addiction, including meals and lodging, are covered. Members can also include in medical expenses amounts paid for transportation to and from Alcoholics Anonymous meetings in the community if the attendance is necessary for treatment.

You May Like: Tummy Massage For Weight Loss

Hsa And Fsa: What Are They

Before we discuss the process of getting a massage with your insurance plan, lets do a quick overview on HSAs and FSAs. These are both special healthcare arrangements that allow you to set aside money for medical costs, such as deductibles, monthly prescriptions, copayments, and coinsurance. You dont pay taxes on this money.

For a detailed list of what costs are considered medical expenses, start with this fact sheet from the IRS. In some cases, your employer will contribute money to your HSA or FSA each year as well. Both of these plans have a lot of fine print youll need to consider, so talk to your HR department if you have questions.

These healthcare plans usually come with a debit card that includes your contributions. In most cases, you wont have to worry about being reimbursed, as your funds will already be on the flex debit card. You can spend this on any of the above medical costs.

How To Use Your Fsa Or Hsa Card To Make Amazon Purchases

Just add your card to your Amazon Wallet along with your other payment method. Please check Amazons frequently asked questions regarding HSAs and FSAs.

All healthcare products on Amazon are not FSA or HSA eligible. You can find a list of FSA and HSA eligible products on Amazon. On the product page, eligible products also display the label FSA or HSA Eligible..

Don’t Miss: Massage Near My Current Location

Hsa Or Fsa: What Are They

Before we go forward with the main topic, lets first go through what HSA or FSA -eligibility is and how it relates to massage guns?

Flexible spending accounts and health savings accounts are similar to personal savings accounts. You can use account funds for only qualifying medical expenses.

Any Employees who have FSA or HSA contribute pre-tax dollars to their accounts, lowering their taxable income.

Employers may choose to add funds to HSA and FSA of employees and it usually counts towards health benefits offered by the company/organization you are working at.

We wont get into the nitty-gritty of the two because it is outside the scope of this article. So, here is a quick rundown of a few key differences between HSA and FSA.

| Health spending account comparison |

|---|

| No |

How Much Can I Save With An Hsa/fsa

More than you might think. Each year, you can save 30-40% from your out-of-pocket expenses by paying for massage with your HSA or FSA. And if you sign up for a membership, you can save even more.

The normal rate for a 1-hour neuromuscular massage is $149, but it can cost as little as $79 for Massage Revolution members. Discounts apply to all our other massages as well. A 1-hour therapeutic massage, normally priced at $99, is only $59 for members. If you get massage regularly, that adds up to thousands in savings every year!

Recommended Reading: Where Can I Get A Massage Tomorrow

Find Out If You Qualify For Massage Coverage

Some, but not all, insurance providers, offer HSAs with their HDHPs.

The first step is to contact your insurance company. Even if your doctor rules massage as medically necessary, some insurance policies still wont cover massages. Dont assume youre covered just because your doctor prescribed the massage. Confirm with your insurance provider before moving forward.

Another important thing to note: self-employed individuals can qualify for HSAs, but are not eligible to open FSAs. This is due to HSAs being owned by the employee, whereas FSAs are owned by your employer. You legally cant make contributions to yourself.